Schedule D Form 1041

Planning ahead is the secret to staying organized and making the most of your time. A printable calendar is a straightforward but powerful tool to help you lay out important dates, deadlines, and personal goals for the entire year.

Stay Organized with Schedule D Form 1041

The Printable Calendar 2025 offers a clean overview of the year, making it easy to mark appointments, vacations, and special events. You can pin it on your wall or keep it at your desk for quick reference anytime.

Schedule D Form 1041

Choose from a range of stylish designs, from minimalist layouts to colorful, fun themes. These calendars are made to be user-friendly and functional, so you can focus on planning without distraction.

Get a head start on your year by grabbing your favorite Printable Calendar 2025. Print it, personalize it, and take control of your schedule with clarity and ease.

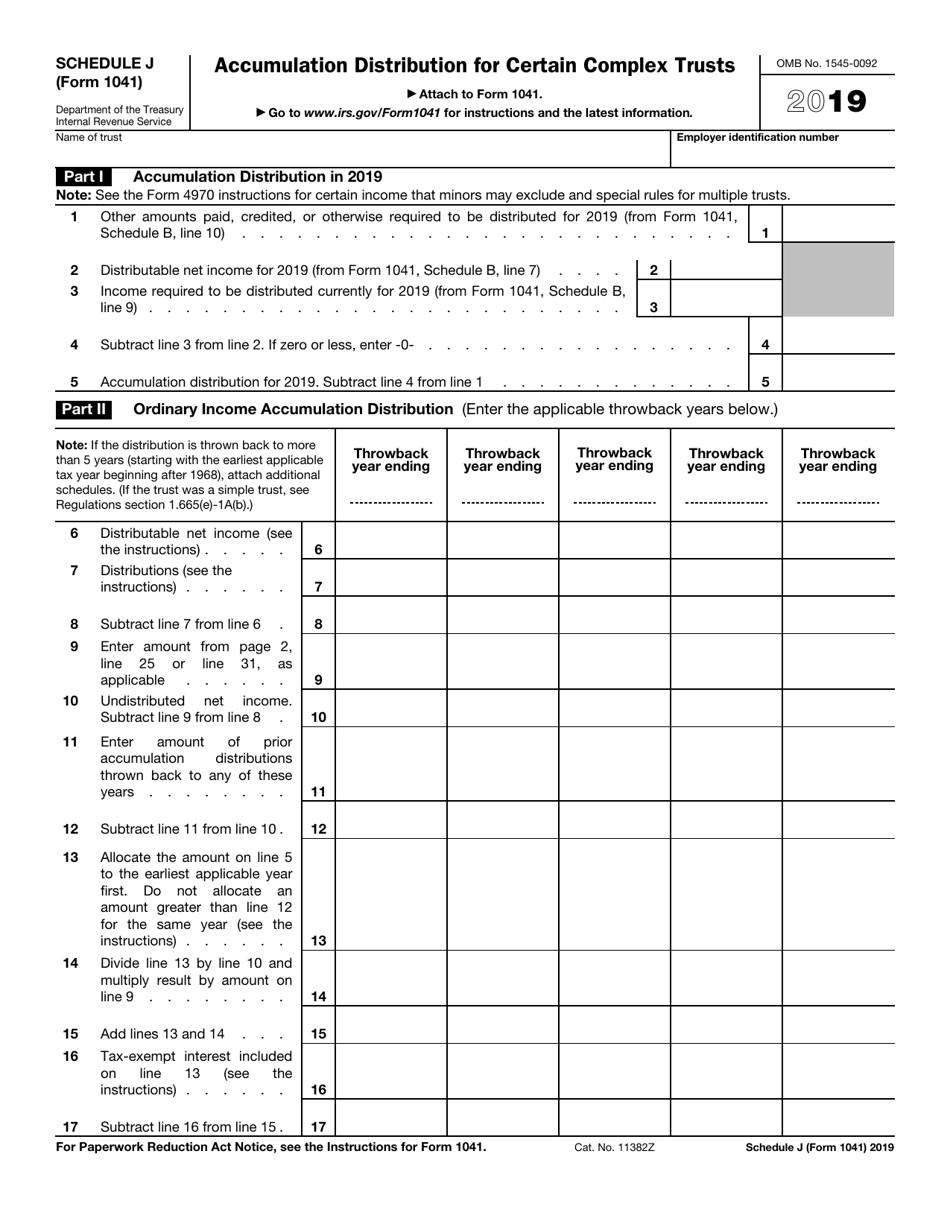

IRS Form 1041 Schedule J Download Fillable PDF Or Fill Online

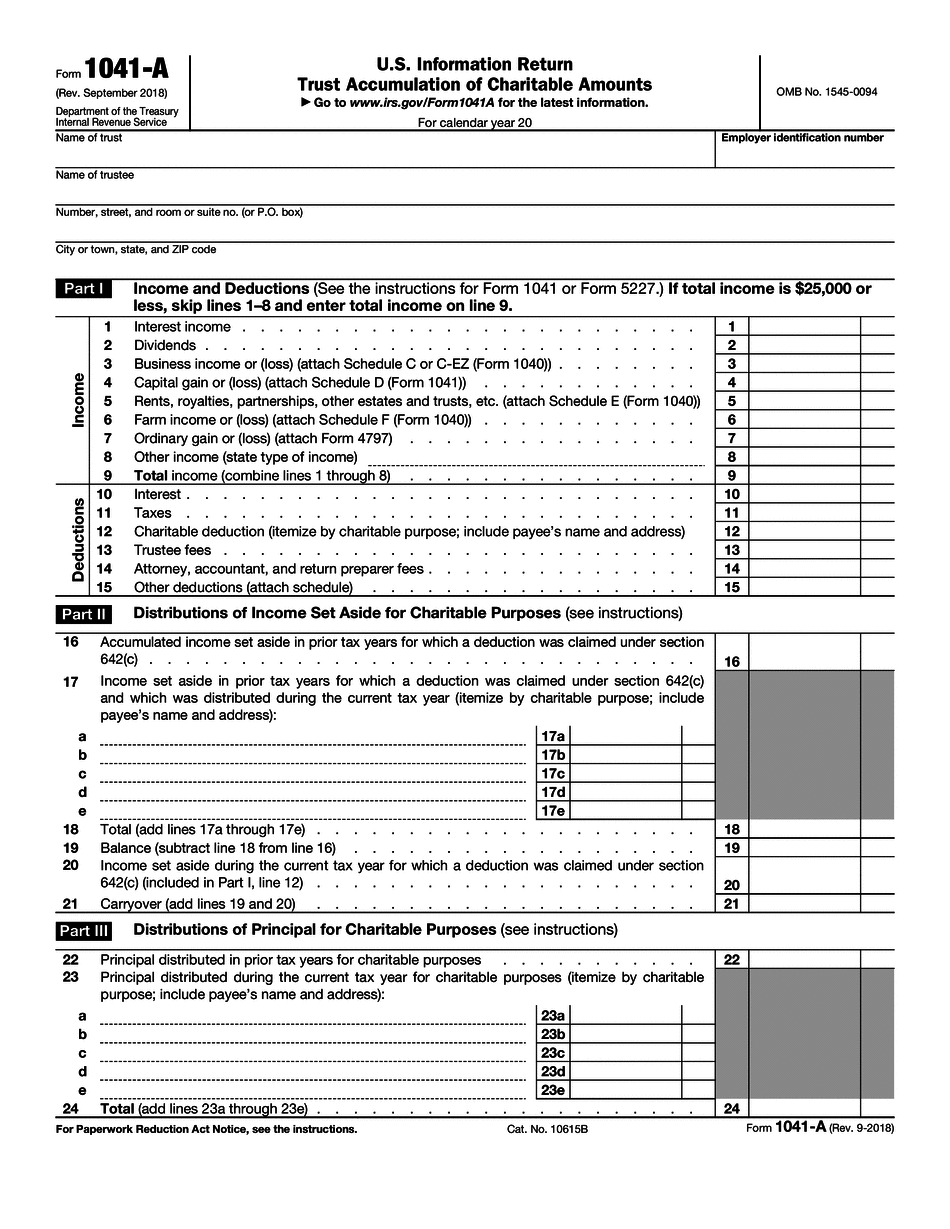

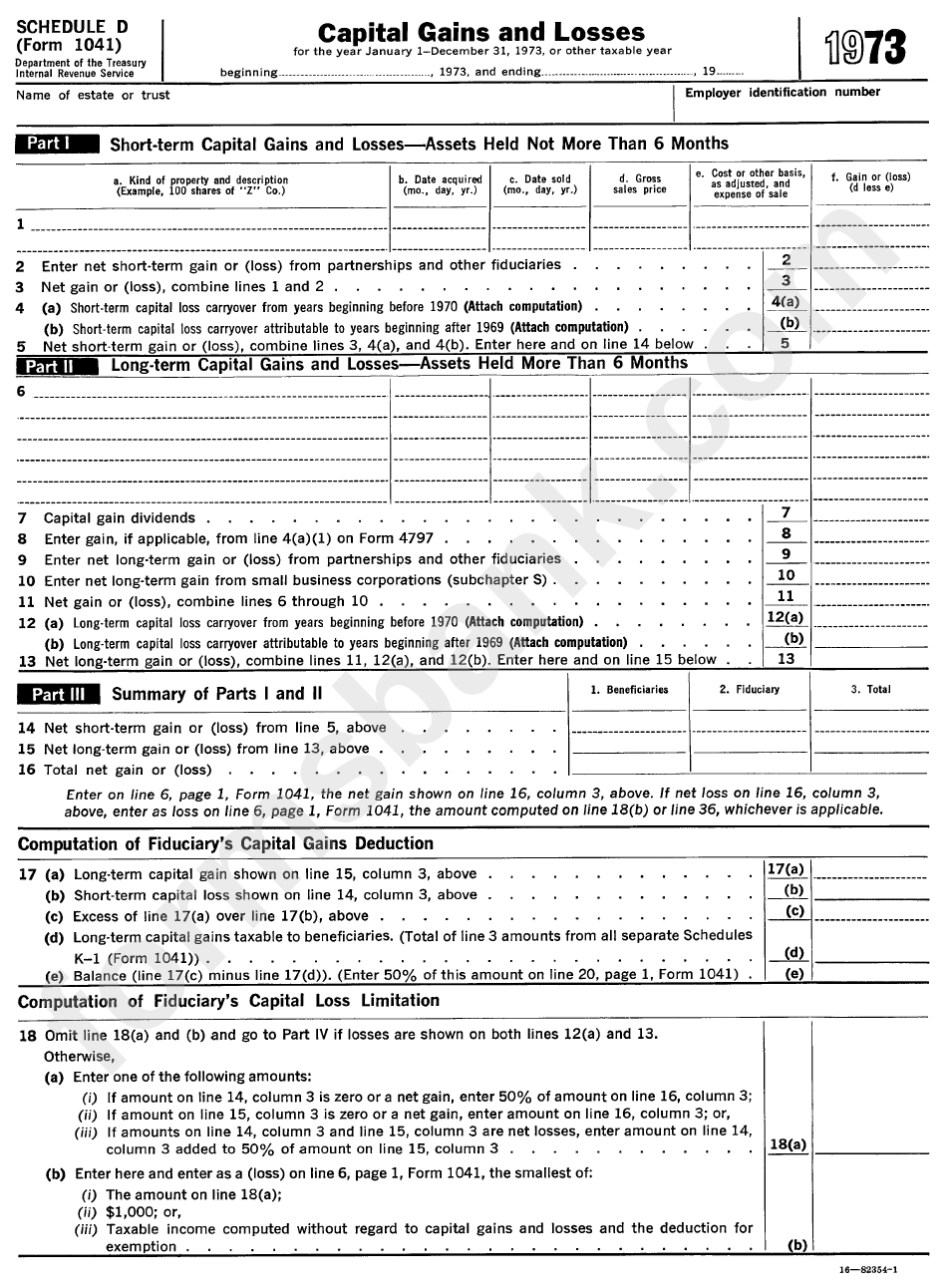

Schedule D Form 1041 is an attachment to Form 1041 which is used to report income deductions and taxes for estates and trusts It specifically focuses on capital gains and losses arising from the sale or exchange of investment assets during the tax year There are amounts on lines 4e and 4g of Form 4952. Exception: Don't use this worksheet to figure the estate's or trust's tax if line 18a, column (2), or line 19, column (2), of Schedule D or Form 1041, line 23 is zero or less; instead, see the Instructions for Form 1041, Schedule G, Part I, line 1a.

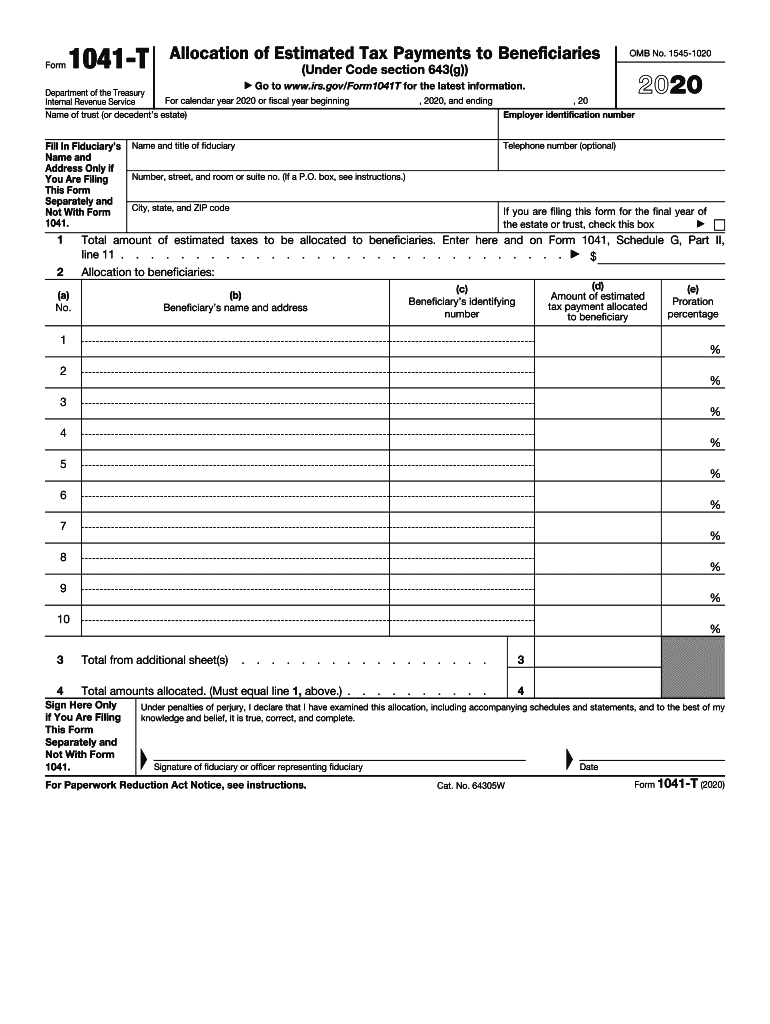

1041 Estimated Tax 2020 2024 Form Fill Out And Sign Printable PDF

Schedule D Form 1041Use Form 1041 Schedule D to report gains or losses from capital assets associated with an estate or trust. Form 1041 Schedule D is a supplement to Form 1041. Make sure you are using the correct Schedule D, as there is a schedule D for Form 1040, but they are not interchangeable. These instructions explain how to complete Schedule D Form 1041 Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D Use Schedule D to report the following The overall capital gains and losses from transactions reported on Form 8949

Gallery for Schedule D Form 1041

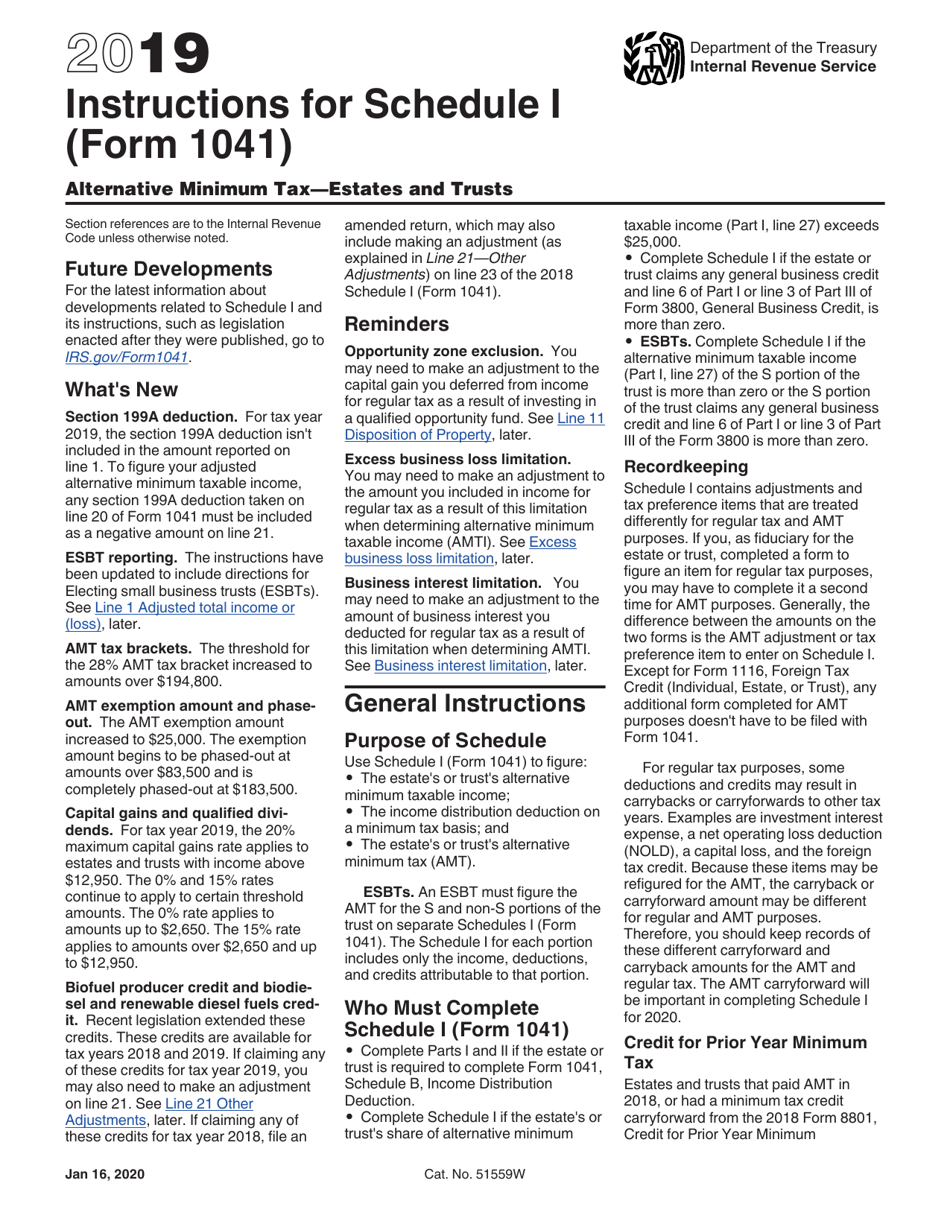

Download Instructions For IRS Form 1041 Schedule I Alternative Minimum

Form 1041 Schedule K 1 Beneficiary s Share Of Income Deductions

Irs Form 1041 For 2023 Printable Forms Free Online

Form 1041 Schedule D Capital Gains And Losses 2014 Free Download

Form 1041 Schedule D Capital Gains And Losses

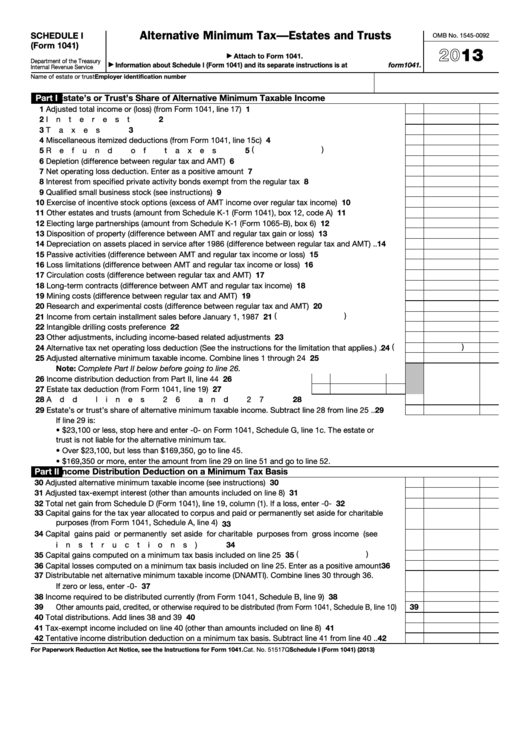

Fillable Schedule I Form 1041 Alternative Minimum Tax Estates And

IRS Form 1041 Schedule I Download Fillable PDF Or Fill Online

Form 1041 Schedule J Accumulation Distribution For Certain Complex

Schedule D Form 1041 Capital Gains And Losses 1973 Printable Pdf

Fill Free Fillable Form 1041 Schedule D PDF Form