Irs Forms 1099 Misc 2024

Planning ahead is the key to staying organized and making the most of your time. A printable calendar is a simple but effective tool to help you lay out important dates, deadlines, and personal goals for the entire year.

Stay Organized with Irs Forms 1099 Misc 2024

The Printable Calendar 2025 offers a clear overview of the year, making it easy to mark meetings, vacations, and special events. You can hang it up on your wall or keep it at your desk for quick reference anytime.

Irs Forms 1099 Misc 2024

Choose from a range of stylish designs, from minimalist layouts to colorful, fun themes. These calendars are made to be user-friendly and functional, so you can focus on planning without clutter.

Get a head start on your year by downloading your favorite Printable Calendar 2025. Print it, customize it, and take control of your schedule with confidence and ease.

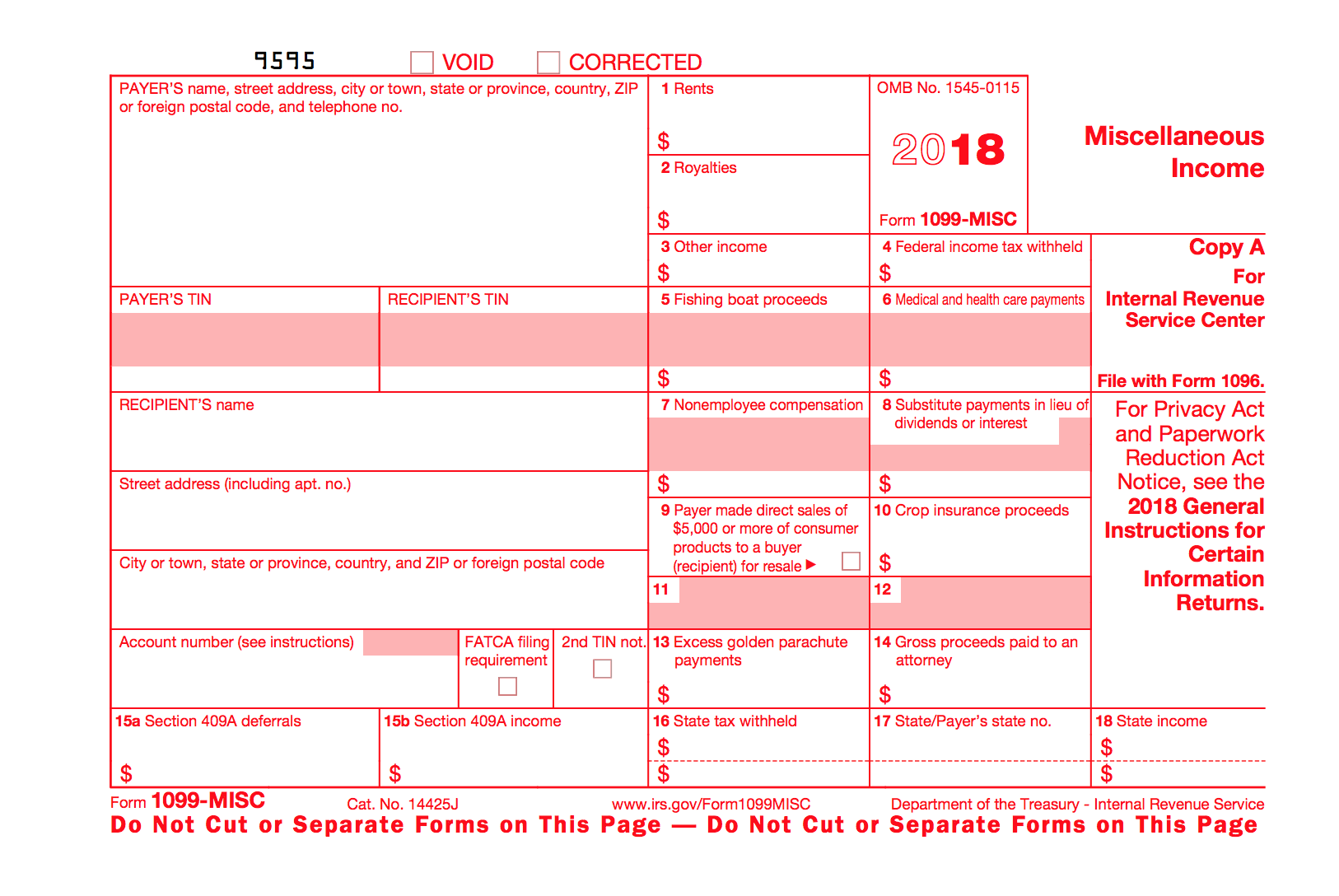

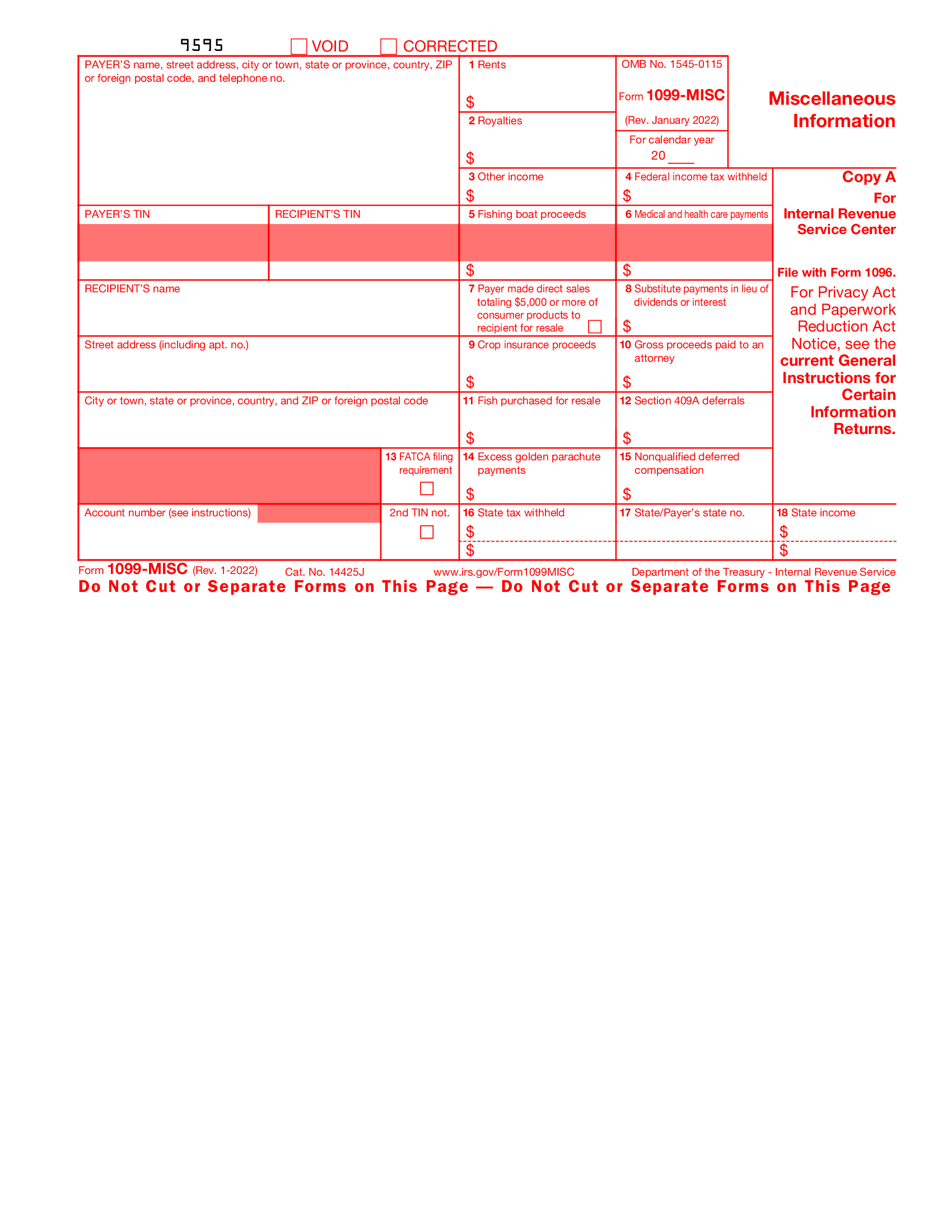

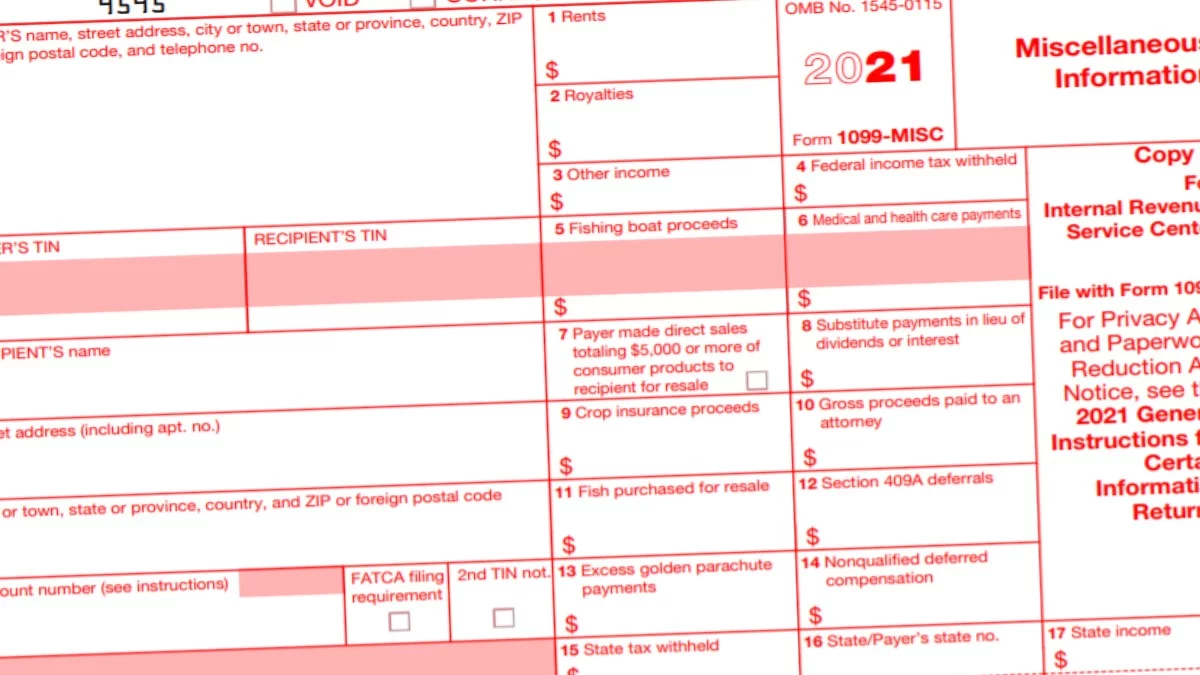

11 Common Misconceptions About Irs Form 11 Form Information Free Printable 1099 Misc Forms

File Form 1099 MISC Miscellaneous Information for each person in the course of your business to whom you have paid the following during the year At least 10 in royalties see the instructions for box 2 or broker payments in lieu of dividends or tax exempt interest see the instructions for box 8 At least 600 in Rents box 1 Home About Form 1099-MISC, Miscellaneous Information File Form 1099-MISC for each person to whom you have paid during the year: At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. At least $600 in: Rents. Prizes and awards. Other income payments. Medical and health care payments. Crop insurance proceeds.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Irs Forms 1099 Misc 2024Last quarterly payment for 2023 is due on Jan. 16, 2024. Taxpayers may need to consider estimated or additional tax payments due to non-wage income from unemployment, self-employment, annuity income or even digital assets. The Tax Withholding Estimator on IRS.gov can help wage earners determine if there's a need to consider an additional tax ... File Form 1099 MISC Miscellaneous Information for each person in the course of your business to whom you have paid the following during the year At least 10 in royalties see the instructions for box 2 or broker payments in lieu of dividends or tax exempt interest see the instructions for box 8 At least 600 in Rents box 1

Gallery for Irs Forms 1099 Misc 2024

2018 Forms 1099 MISC Due January 31 2019 Miami CPA Bay PLLC

Fillable 1099 Misc Irs 2022 Fillable Form 2023

1099 MISC Form 2023 2024

Www irs gov Forms 1099 Form Resume Examples XE8jY2e3Oo

IRS 1099 MISC 2009 Fill Out Tax Template Online US Legal Forms

Downloadable 1099 Tax Forms Irs Tax Forms 1099 A Federal Copy A 1099 Tax Form Tax Forms Irs

Irs gov Forms 1099 Int Form Resume Examples ko8L9mL19J

Form 1099 Misc Printable Printable Forms Free Online

Irs Forms 1099 Misc Instructions Form Resume Examples My3aR6a8wp

Irs 1099 Misc Correction Form Universal Network